Special Servicing

Comprehensive solutions for distressed commercial real estate

We provide a wide array of Specialty Servicing and Asset Management services to clients and take a proactive approach in monitoring our clients' portfolios to identify existing or potential issues, enabling clients to remediate problems before they negatively affect the asset. We provide these services to a wide range of clients, including Investment Funds, nationwide Private Equity firms, and regional and national Lenders. These services include:

- Primary servicer oversight and surveillance

- Managing loan default processes

- Negotiating loan refinancing, modifications, extensions, whole loan sales, and debt workouts or restructuring

- Foreclosing on properties as necessary and managing REO remediation and disposition

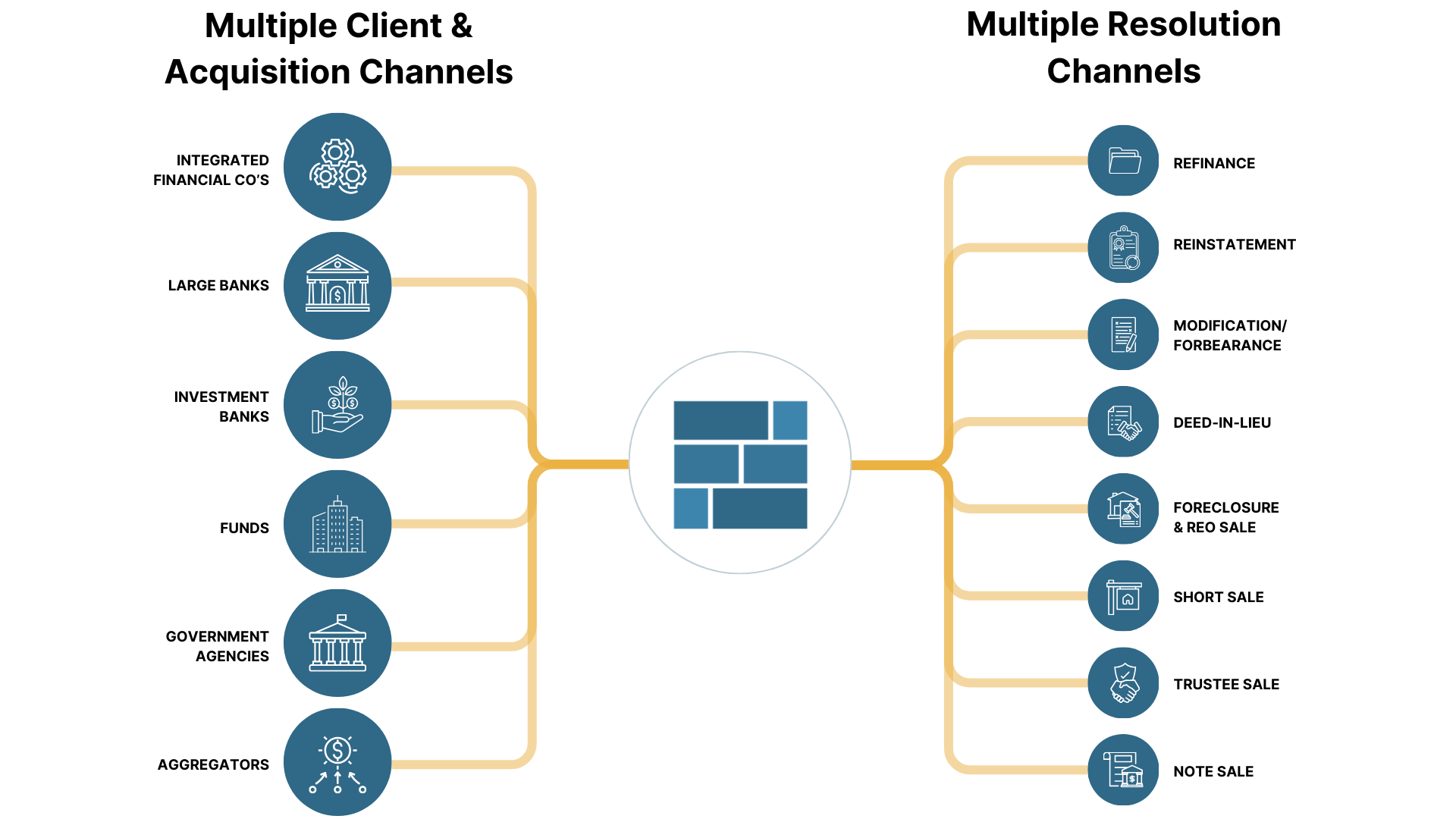

Multi-Dimensional Special Servicing and Asset Management Services

Multiple Client Channels

- INTEGRATED FINANCIAL CO'S

- LARGE BANKS

- INVESTMENT BANKS

- FUNDS

- GOVERNMENT AGENCIES

- AGGREGATORS

Multiple Resolution Channels

- REFINANCE

- REINSTATEMENT

- MODIFICATION/FORBEARANCE

- DEED-IN-LIEU

- FORECLOSURE & REO SALE

- SHORT SALE

- TRUSTEE SALE

- NOTE SALE

Our Services

Foundation offers comprehensive Special Servicing and Asset Management solutions tailored to manage distressed commercial real estate effectively. Our proprietary technology platform and experienced team ensure optimal outcomes for non-performing loans (NPLs) through proactive strategies.

- Loan Servicing & Oversight: Ensuring strict adherence to servicing guidelines and managing the complete lifecycle of distressed assets.

- Asset Management: Maximizing recovery and minimizing losses through AI-driven, real-time market analysis, strategic planning, and tailored management solutions.

- Loan Modification & Restructuring: Negotiating modifications, refinancings, and debt restructurings to optimize borrower and lender outcomes.

- Foreclosure & REO Management: Providing end-to-end foreclosure and REO disposition services for maximum asset recovery.

- Loan Sales & Acquisitions: Facilitating the sale and acquisition of distressed loans through a transparent, tech-enabled marketplace.

Roles and Responsibilities

Foundation

-

Asset Review / Due Diligence

- Sourcing

- Pool / Loan level diligence

- Transaction closing and management

- Management of servicing reconciliations

- Management of loan boarding

-

Foreclosure

- Attorney / Trustee management

- Invoice payment management

- Coordination with Loss Mitigation and Bankruptcy Departments

- Loan level review

-

Bankruptcy (FNMA, FHA, CFPB, RESPA, FDCPA)

- Attorney management

- Invoice payment management

- Special payment posting processing

- Coordination and Management of Servicer Loss Mitigation and Foreclosure Departments

- Loan level review

-

Loss Mitigation

- Loan/Asset Level Review and Approval

- Implementation and facilitation of all loss mitigation and asset resolution strategies

-

Investor Reporting

- Monthly remittance

- Reconciliation

- Remittance timelines

- Portfolio reporting

-

Vendor Oversight / Management

- Collateral valuation

- Lien and title analysis

- Property preservation

- Forced place insurance

- Loan origination and compliance reviews

-

Servicer Oversight / Quality Control Reviews

- Three-month servicing QC reviews

- Management responses

- Management action plans

Primary Servicer

-

Borrower Services / Single Point of Contact

- Call center operations

- Complaint handling

- Escalation handling

- Customer call quality control

- Error resolution

- Letter administration

- Loan level review

-

ARM or Bridge Maintenance

- Review ARM maintenance process

- Index maintenance

- Letter administration

- Error resolution

-

Escrow Management (FNMA, FHA, CFPB, RESPA)

- Insurance monitoring process

- Claims processing

- Letter administration

- Tax monitoring process

- Error resolution

-

Cash Management (FNMA, FHA, CFPB, RESPA)

- Collections

- Check handling procedures

- Payment reversal procedures

- BK Payments

- Post-dated payment handling

- Error resolution

- Letter administration

-

Loss Mitigation (FNMA, FHA, CFPB, RESPA, FDCPA)

- Call campaigns

- SPOC

- Letter administration

- Quality Control

-

Foreclosure (FNMA, FHA, CFPB, RESPA, FDCPA)

- Foreclosure referral procedures