Cutting-Edge Tech Meets Real Estate Finance

Integrating Technology with Real Estate Finance for Origination, Servicing, and Fund Management

Integrated Loan Processing for Seamless Origination

Our integrated loan processing system automates key steps in loan origination, from document verification to borrower screening, ensuring accurate data capture and faster loan approvals. This approach reduces manual errors and enables consistent, scalable processing for both direct and third-party originations.

AI-Enhanced Document Analysis and Fraud Detection

Using AI-driven algorithms, our platform analyzes documents for signs of tampering, inconsistencies, and fraud, significantly increasing detection accuracy. This ensures that fraudulent applications are identified and addressed early, protecting the integrity of our loan portfolio.

Data-Driven Credit Scoring for Smarter Underwriting

Our data-driven credit scoring model uses predictive analytics to assess borrower risk more accurately, enabling more informed underwriting decisions. This approach enhances the quality of loan portfolios by aligning lending decisions with real-time risk factors and market data.

Automated Workflows for Better Borrower Experience

Automated workflows optimize every stage of the borrower journey, from initial application to funding, reducing delays and increasing transparency. This streamlined process not only improves borrower satisfaction but also accelerates turnaround times, allowing faster access to capital.

Automate. Connect. Harness. Integrate. Enhance. Validate. Empower.

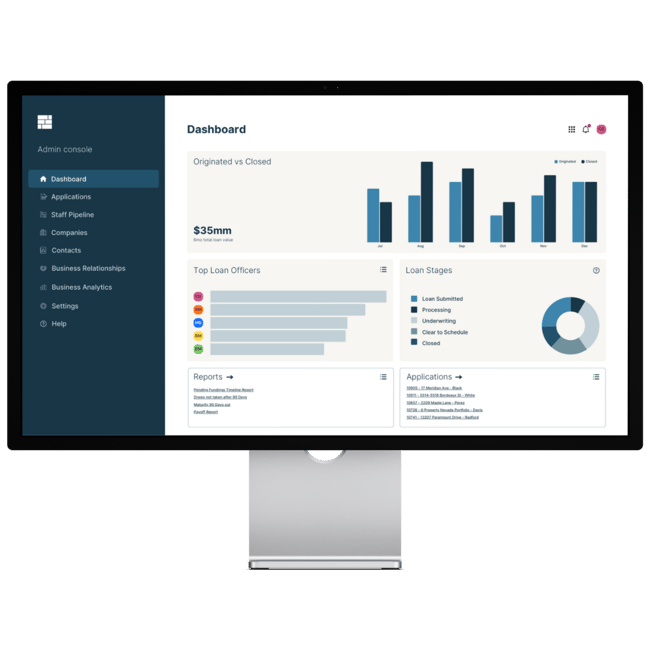

ACHIEVE is Foundation's cutting-edge platform that streamlines real estate special servicing, private lending, and transaction management. Built on a decade of industry expertise, it offers:

Real-time, AI-powered analytics for informed decision-making

Integrated loan pricing and asset purchase approval systems

Early access to pre-foreclosure and REO assets through PropertyPortal™

Pre-Qualification and Deal Submission

Our intuitive online portal features a dynamic submission form that automatically pre-qualifies potential deals against our lending criteria. The system seamlessly integrates with our CRM and loan origination systems, enabling efficient processing of qualified leads from initial inquiry through formal application.

Term Sheet & Loan Application

Our comprehensive self-service portal empowers borrowers and brokers to efficiently manage documents, monitor application status in real-time, and complete dynamic loan applications, while automatically generating customized term sheets for immediate electronic signature and processing.

AI Document Analysis & Fraud Detection

Using AI services and tools, our platform analyzes documents for signs of tampering, inconsistencies, and fraud, significantly increasing detection accuracy. This ensures that fraudulent applications are identified and addressed early, protecting the integrity of our loan portfolio.

Doc Automation and Storage

Our cloud-based platform automatically generates and manages all critical loan documentation, including legal agreements, term sheets, and closing documents, ensuring consistency and compliance across our portfolio.

Underwriting

Automated underwriting powered by third-party API services enhances lending efficiency and reduces manual review. Comprehensive capabilities include multi-source credit reports, property valuations, flood certifications, background checks, appraisal ordering, asset verification, OCR document processing, and advanced risk scoring.

Loan Processing and Closing

Our customized loan origination system streamlines the entire loan pipeline, automating workflows and standardizing due diligence procedures for consistent, efficient processing. This tailored platform ensures thorough documentation while significantly reducing time to close.

Loan Servicing and Draw Management

Our integrated servicing and asset management platform ensures seamless transition of loans from origination to servicing while providing comprehensive oversight of draws. The system automates draw processing and monitoring, maintaining real-time visibility of project progress and loan performance.

Intelligent Solutions

for Real Estate Finance

Integrating industry-leading applications and data providers into one fully integrated, AI-enabled technology platform for real estate finance.

Ocrolus

Automates document analysis for efficient loan underwriting, enhancing fraud detection and streamlining financial decision-making processes.

Forecasa

Delivers data-driven market intelligence and analytics, enhancing lead generation and due diligence in underwriting processes.

Decipher

Powers loan origination and underwriting, driving efficiency gains through automation and streamlining the entire lending process.

HubSpot

Drives lead generation and sales funnel management, syncing with our lending system for streamlined operations.

Pyramid Platform

Manages loss mitigation and REOs through task-driven workflows, enhancing flexibility in property portfolio oversight.

Plaid

Enables automated bank verification and fraud detection, streamlining risk assessment processes through secure financial data integration and analysis.

Costar

Provides comprehensive commercial real estate data and analytics, empowering informed decision-making in asset management and loan origination processes.

vLoans

Centralizes asset portfolio management and serves as an enterprise data warehouse, enabling comprehensive oversight and analytics of lending operations.

Zapier

Facilitates seamless system integration and automated data flows between platforms, enhancing operational efficiency through simplified API connections.

SiteXPro

Empowers underwriting due diligence with vast, accurate property datasets, mitigating risks and enhancing decision-making precision.

homegenius

Provides crucial comparable data for asset valuation, enriching underwriting insights with exclusive market intelligence.

TitleEase + Resware

Integrates Resware workflow automation for streamlined title and escrow processes, enhancing underwriting efficiency.

PropertyPortal™

AI-Enhanced Auction Marketplace

PropertyPortal transforms the real estate auction experience with the power of ALFReD AI and Homegenius technology. The platform leverages advanced data analytics and intelligent AI-driven insights to deliver real-time property valuations, trend analysis, and predictive risk assessments. Buyers benefit from access to detailed historical data and transparent market information, enabling more informed bidding decisions and reducing investment risks.